Something that has been talked about repeatedly during the Covid-19 crisis is just how much we don't know. It has been a lesson in how limited our foresight can be.

At first, we did not know how far or how quickly the virus might spread. Neither did we know how severe it may turn out to be.

Once governments started imposing lockdown restrictions, we did not how long these might last, or how they would be lifted. We couldn't be sure how many jobs would be lost, or how household incomes would be impacted.

The economic impact remains a point of extensive debate. How deep will the recession be? And how long will it last? Could economies still bounce back as quickly as we originally hoped they would?

As countries ease lockdown restrictions, how many people will be able to return to the jobs they had before Covid-19? Which sectors will return to productivity quickly, and which will continue to struggle?

History and the Market

The same can be said of investing and trying to forecast the right time to de-risk or withdraw your money and the right time to invest or be more aggressive. History and past experiences can be a great help here however given the many upheavals economies and investment markets have experienced over many decades.

Fund managers Dimensional just recently produced some interesting statistics around trying to time the stock markets. They can be summarised as follows:

- If you invested $1,000 in US Stocks in 1970, they would be worth circa $121,000 today.

- If the best single performing day was missed, they would be worth circa $109,000 today.

- Miss the five best days and they would be worth circa $77,000

- Or miss the best fifteen days and they would be worth circa $43,000

- And finally, miss the best twenty five days – circa $27,000

The key takeaway from this is consistent with what is mentioned above being “there’s no proven way to time the market” and the best approach is the “stay in your seat”.

Market Performance since Covid

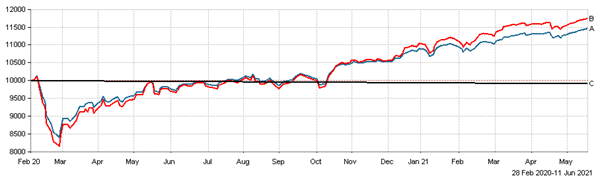

The natural reaction when the pandemic struck was to be very cautious and indeed in the immediate period after February 2020 showed a fall in market values. Consistently since March 2020 the markets have performed steadily as can be seen from the chart below. This shows the performance of the “Managed Balanced” fund sector, the “Managed Aggressive” fund sector and the “Cash” sector from 28th February 2020 to 11th June 2021:

Source: FE FundInfo

€10,000 invested on 28th February 2020 is now worth on 11th June 2021:

A - €11,460.24 using the managed balance sector average (+ 14.6%)

B - €11,740.24 using the managed aggressive sector average (+ 17.4)

C - €9,912.73 using the cash sector average (- 0.87%)

In an ideal world we would all like to avoid declines. The anxiety that keeps investors on the side-lines may save them that pain, but it may ensure the gain is missed. Historically, each downturn has been followed by an eventual upswing, although there is no guarantee that will always happen. Trying to avoid risk could itself be risky, since it is impossible to know when the right time is to get back in.

One of the key things here is access to sound advice and a good financial advisor will passenger alongside you on the journey.